And to balance the accounting equation, we see the removal of the treasury stock from the asset side. It is useful to note that when the corporation has more than one type of stock, the additional paid-in capital account above should be broken down to identify which type of stock it belongs to. This is why we may see the account such as “paid-in capital in excess of par-common stock” instead of just “additional paid-in capital” in the journal entry for the issuance of common stock above. In accounting, when the company issues the common stock, its price will be used to compare with the par value or stated value of such stock before the journal entry is made. The journal entry for issuing the common stock for cash will increase both total assets and total equity on the balance sheet.

Journal entry for issuing common stock for service

Moreover, the company may issue a share to acquire another company by giving the business owner share equity. The company needs to record the assets value, common stock, and additional paid-in capital, which is the same as the stock issue for cash. However, the transaction amount depends on assets market value or common stock market value whichever can be measured more reliability. Most of the time, company issue the common stock for cash and use it for other purposes. Investors simply purchase the stock from the issuer and gain ownership over the company’s share.

Reissuing Treasury Stock above Cost

There are three types of transactions you will need to know when preparing a journal entry for common stock. These are issuing stock exchange for cash, for other non-cash assets or companies buying back their own stock. 5As mentioned earlier, the issuance of capital stock is not viewed as a trade by the corporation because it merely increases the number of capital shares outstanding. That is different from, for example, giving up an asset such as a truck in exchange for a computer or some other type of property. The $5,000 of the common stock account in the journal entry comes from the 5,000 shares multiplying with the $1 per share of the par value. And the $45,000 of the additional paid-in capital comes from the $50,000 amount which is the total market value of shares of common stock given up deducting the $5,000.

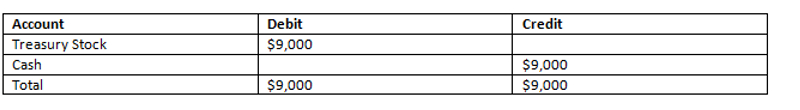

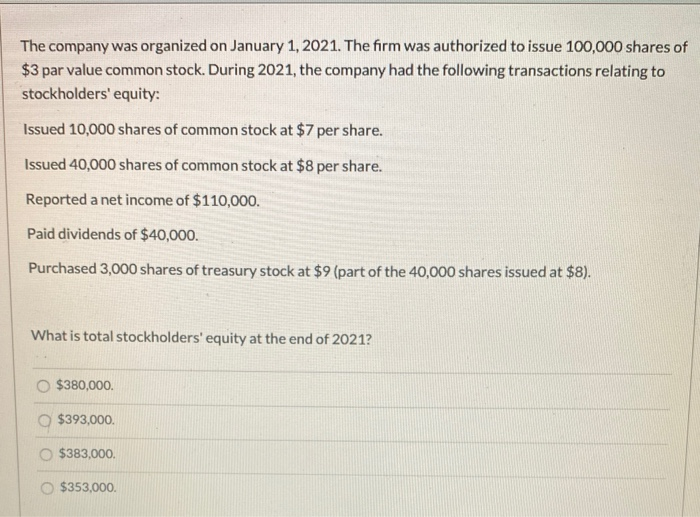

FAR CPA Practice Questions: Journal Entries for Treasury Stock Transactions

Rather, they were reported under this heading within stockholders’ equity and subsequently used in computing comprehensive income. Common shares are one type of security that companies may issue to raise capital. In this journal entry, the credit of the common stock is the entire proceeds we receive from issuing of the common stock. As the common stock has no par value, regardless of how high the market value is, there won’t be any additional paid-in capital involved here.

Impact on statement of cash flows

Although not mentioned directly, Kellogg now has only 382 million shares of common stock outstanding in the hands of the stockholders (419 million issued less 37 million treasury shares). Selling common shares to investors is a common method for companies to raise capital. This capital is used by the company to fund operations, invest in assets, and pay salaries. When a company issues common shares, it is selling ownership in the company to investors in exchange for cash. These investors then become shareholders, and their ownership stake in the company is based on the percentage of shares they hold.

- Assume that onAugust 1, La Cantina sells another 100 shares of its treasurystock, but this time the selling price is $28 per share.

- Kellogg reports that one billion shares of common stock were authorized by the state of Delaware but only about 421 million have actually been issued to stockholders as of the balance sheet date.

- Selling common shares to investors is a common method for companies to raise capital.

- Of course, the par value of the common stock has nothing to do with its market value.

- The company charges $150 per share for this issuance, making the overall finance received $150,000.

Stock Dividends Journal Entries

In the case of common stock, it just represents a legally binding contract that the stock will not be sold below a certain price, like $0.1 per share or $0.01 per share, etc. Moreover, the par value of a common stock often doesn’t have any connection with its dividend rate. Rather, the dividends on common stock are generally announced as a certain dollar amount per share, like $5 per share or $10 per share, etc. To determine the dividend yield metric, investors can simply divide this per share dividend amount by the per share cost. Common stock has also been mentioned in connection with the capital contributed to a company by its owners. However, Kellogg communicates additional information about its common stock such as the number of authorized and issued shares as well as its par value.

Issuing share capital allows companies to raise the funds they need to grow and develop. Likewise, if we issue the common stock at par value there will be no additional paid-in capital in the record. In this case, we can make the journal entry for the issuance of common stock at par value with the debit of the cash account and the credit of the common stock account. The number of issued shares accounting for entrepreneurs tips to follow when starting out is simply the quantity that has been sold or otherwise conveyed to owners. Kellogg reports that one billion shares of common stock were authorized by the state of Delaware but only about 421 million have actually been issued to stockholders as of the balance sheet date. The remaining unissued shares are still available if the company needs to raise money by selling additional capital stock.

The company usually sets an authorized share higher than their current need. Management may decide to retire treasury stock in balance sheet. The company is able to sell the stock back at a higher price when it buyback.

So the company needs to record more additional paid-in-capital into the balance sheet. Because we have worked through a lot of the detail you would be expected to know in the cash example; we will keep this example much simpler. And one reason for this is often these types of transactions don’t involve the application, allotment and call process that you would see in an offering of shares for cash. In the case of an oversubscription, the prospectus stated that the share bundles would be allocated on a first-come-first-serve basis. But no one shareholder allowed an allocation of more than one bundle.