Organizations can achieve a 40% increase in close productivity, resulting in a more streamlined financial close process and allowing your team to focus on more strategic activities. With the use of modern accounting software, this process often takes place automatically. Notice that the balance of the Income Summary account is actually the net income for the period. Remember that net income is equal to all income minus all expenses. The term can also mean whatever they receive in their paycheck after taxes have been withheld.

What are Temporary and Permanent Accounts?

All revenue and expense accounts must end with a zero balance because they’re reported in defined periods. A hundred dollars in revenue this year doesn’t count as $100 in revenue for next year even if the company retained the funds for use in the next 12 months. After these entries, all temporary accounts (revenue, expenses, dividends) will have zero balances, and the net income and dividends will be reflected in the Retained Earnings account. Businesses can easily open and close accounts every period by using accounting software to track all financial transactions throughout a given period. Automating accounting opening entries and closing entries can help streamline this process, so you don’t have to.

Permanent versus Temporary Accounts

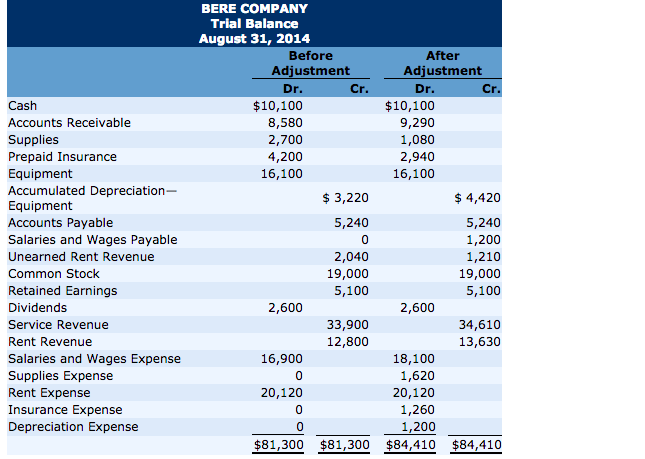

Once we have made the adjusting entries for the entire accounting year, we have obtained the adjusted trial balance, which reflects an accurate and fair view of the bakery’s financial position. A net loss would decrease owner’s capital, so we would do the opposite in this journal entry by debiting the capital account and crediting Income Summary. In essence, we are updating the capital balance and resetting all temporary account balances. When dividends are declared by corporations, they are usually recorded by debiting Dividends Payable and crediting Retained Earnings.

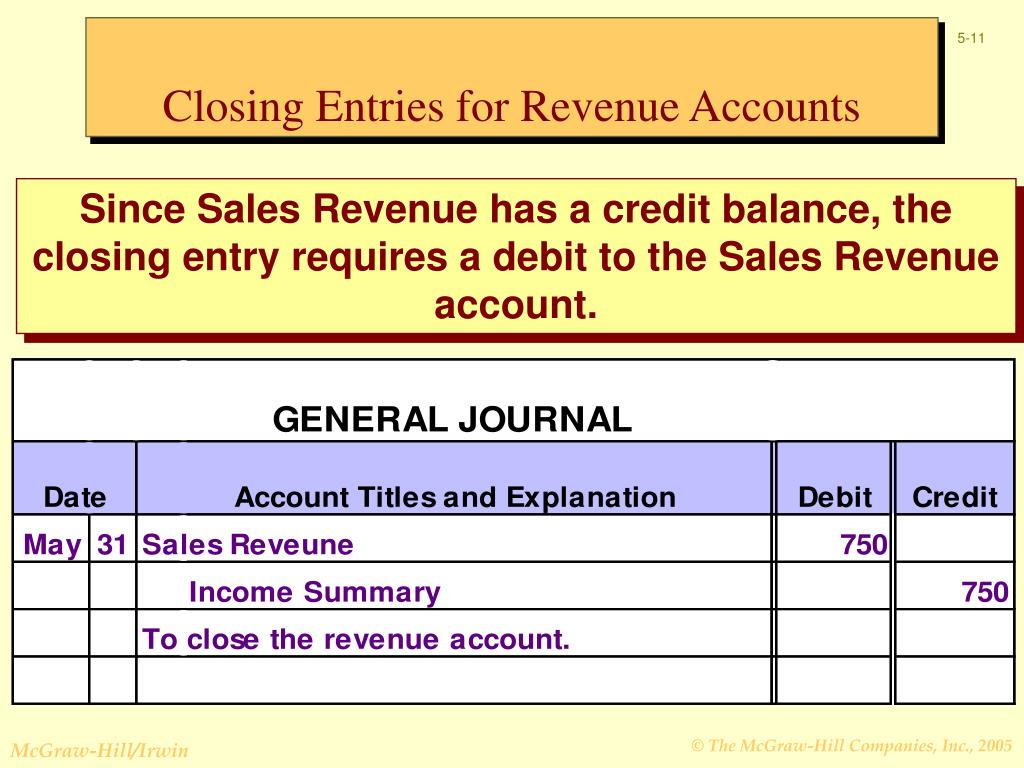

Closing Journal Entries

We can also see that the debit equals credit; hence, it adheres to the accounting principle of double-entry accounting. On the statement of retained earnings, we reported the ending balance of retained earnings to be $15,190. We need to do the closing entries to make them match and zero out the temporary accounts. Suppose a business had the following trial balance before any closing journal entries at the end of an accounting period. In this example we will close Paul’s Guitar Shop, Inc.’s temporary accounts using the income summary account method from his financial statements in the previous example.

Types of Temporary Accounts Include:

- If dividends were not declared, closing entries would cease at this point.

- It is also important to note that the income summary account is primarily used in the manual accounting process.

- Most small companies close their books monthly, though some only do so at year’s end.

- He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

- However, you might wonder, where are the revenue, expense, and dividend accounts?

Any account listed on the balance sheet is a permanent account, barring paid dividends. On the balance sheet, $75 of cash held today is still valued at $75 next year, even if it is not spent. Notice that the Income Summary account is now zero and is ready for use in the next period.

The total of the income summary account after the all temporary accounts have been close should be equal to the net income for the period. Income summary effectively collects NI for the period and distributes the amount to be retained into retained earnings. Balances from temporary accounts are shifted to the income summary account first to leave an audit trail for accountants to follow. Income summary is a holding account used to aggregate all income accounts except for dividend expenses. It’s not reported on any financial statements because it’s only used during the closing process and the account balance is zero at the end of the closing process.

Temporary accounts can be found on the income statement, while permanent accounts are located on the balance sheet. Temporary accounts are the type of accounts that must be opened and closed during these reporting cycles. Temporary accounts can be found in the accounting ledger, specifically the general ledger of accounts.

If you made tax payments, owe business taxes or received a notice to file a business tax return, you must file all outstanding tax returns and pay taxes owed before we can deactivate your EIN. Debit the Income Summary account and credit each expense account. The third entry requires Income Summary to close to the Retained Earnings account. To get a zero balance in the Income Summary account, there are guidelines to consider. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.

The assumption is that all income from the company in one year is held for future use. One such expense that’s determined at accounting the end of the year is dividends. The last closing entry reduces the amount retained by the amount paid out to investors.