Finally, we see that Clear Lake must have issued additional common stock, as their common stock balance increased from $75,000 to $80,000. A cash flow statement tracks the inflow and outflow of cash, providing insights into a company’s financial health and operational efficiency. Therefore, the cash flow statement is crucial for understanding the liquidity and operational efficiency of the business, which is vital for day-to-day operations and strategic planning.

Cash From Operating Activities

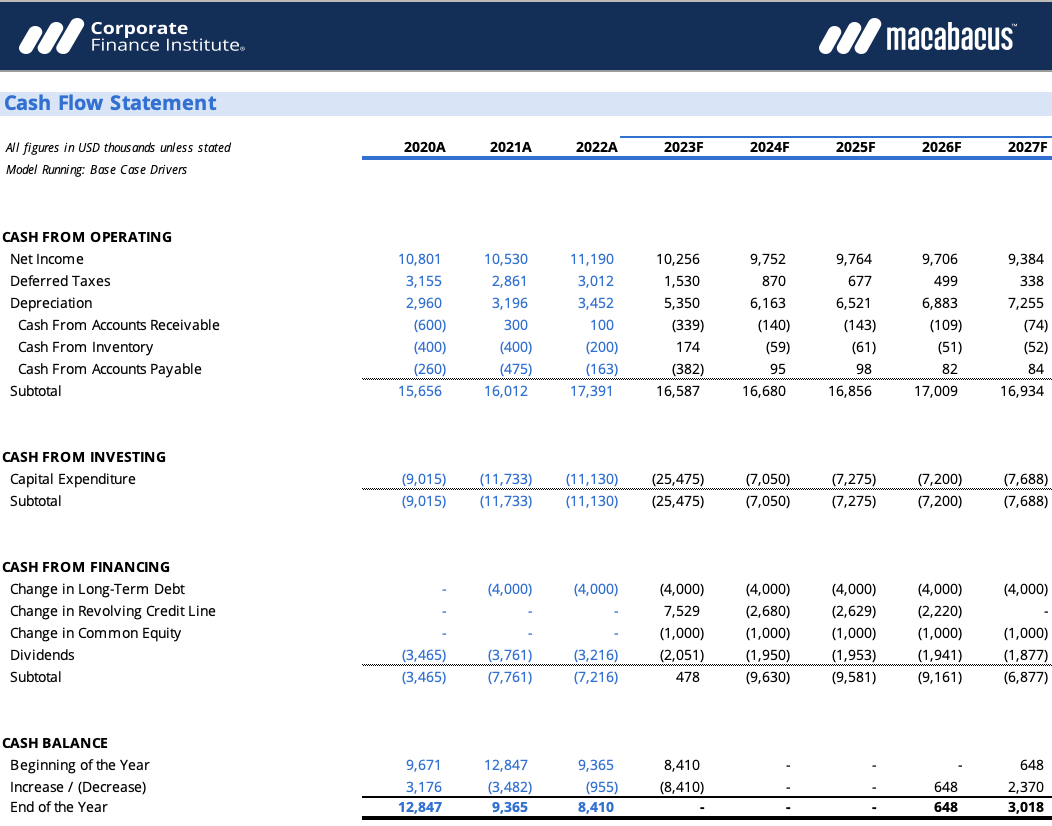

In contrast, a cash flow statement focuses specifically on the movement of cash within an organization over a reporting period, categorizing cash activities into operating, investing, and financing activities. Cash flow is the movement of money into and out of a company over a certain period of time. If the company’s inflows of cash exceed its outflows, its net cash flow is positive. This information can be of great interest to investors as an indicator of a company’s financial health, especially when combined with other data. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. It also includes all cash outflows that pay for business activities and investments during a given period.

Calculated Using the Direct Cash Flow Method

- It reports the value of a business’s assets that are currently cash or can be converted into cash within a short period of time, commonly 90 days.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- Investors and analysts should use good judgment when evaluating changes to working capital, as some companies may try to boost their cash flow before reporting periods.

Investing activities include cash flow from purchasing or selling assets—think physical property, such as real estate or vehicles, and non-physical property, like patents—using free cash, not debt. If you do your own bookkeeping in Excel, you can calculate cash flow statements each month based on the information on your income statements and balance sheets. If you use accounting software, it can create cash flow statements based on the information you’ve already entered in the general ledger. Cash and cash equivalents are consolidated into a single line item on a company’s balance sheet. It reports the value of a business’s assets that are currently cash or can be converted into cash within a short period of time, commonly 90 days.

Is the Indirect Method of the Cash Flow Statement Better Than the Direct Method?

As mentioned, operating activities are those that are used or generated by the day-to-day operations of the firm. The operating activities section of the statement of cash flows begins with net income. All lines thereafter, in that section, are then adjustments to reconcile net income to actual cash flows by adding back noncash expenses like depreciation and adjusting for changes in asset and liability accounts. It is a crucial statement, as it shows the sources of and uses of cash for the firm during the accounting period.

Using this method, cash flow is calculated through modifying the net income by adding or subtracting differences that result from non-cash transactions. This section records the cash flow between the company, its shareholders, investors, and creditors. Analysts look in this section to see if there are any changes in capital expenditures (CapEx). Analysts use the CFF section to determine how much money the company has paid out via dividends or share buybacks. It’s also useful to help determine how a company raises cash for operational growth.

Determine the Ending Balance

However, the indirect method also provides a means of reconciling items on the balance sheet to the net income on the income statement. As an accountant prepares the CFS using the indirect method, they can identify increases and decreases in the balance sheet that are the result of non-cash transactions. This cash flow statement is for a reporting period that ended on Sept. 28, 2019. As you’ll notice at the top of the statement, the opening balance of cash and cash equivalents was approximately $10.7 billion.

The statement also reveals the sources and uses of certain cash flows, which would not otherwise be readily apparent to the reader. These line items include changes in each of the current asset accounts, as well as the amount of income taxes paid. Meaning, even though our business earned $60,000 in October (as reported on our income statement), we only actually received $40,000 in cash from operating activities. When your cash flow statement shows a negative number at the bottom, that means you lost cash during the accounting period—you have negative cash flow.

Negative cash flow should not automatically raise a red flag without further analysis. Poor cash flow is sometimes the result of a company’s decision to expand its business at a certain point in time, which would be a good thing for the future. Changes in cash from financing are cash-in when capital is raised and cash-out when dividends are paid. Thus, if a company issues a bond to the public, the company receives cash financing. However, when interest is paid to bondholders, the company is reducing its cash. And remember, although interest is a cash-out expense, it is reported as an operating activity—not a financing activity.

The balance sheet and cash flow statement are fundamental tools in financial analysis. However, these documents serve distinct purposes and offer different insights into stimulus check your organization’s financial health. The starting cash balance is necessary when leveraging the indirect method of calculating cash flow from operating activities.

Cash flows from financing consists of cash transactions that affect the long-term liabilities and equity accounts. In other words, the financing section on the statement represents the amount of cash collected from issuing stock or taking out loans and the amount of cash disbursed to pay dividends and long-term debt. You can think of financing activities as the ways a company finances its operations either through long-term debt or equity financing. Cash flows from operating activities include transactions from the operations of the business.